I’ve recently had several clients ask me to speak to their kids about money and investing.

Anticipating both limited time, and limited attention spans (on behalf of the kids, of course) I spent a lot of time thinking about how to do this.

I knew that the materials and the discussion would need to be highly focused. There is just too much that I could talk to kids about. It made me think:

Is there one thing so fundamental, so incredibly important, that it should be communicated (taught?) above everything else?

After much thought, I came to a clear view. There is such a thing. As you’ll see why below, I called it the “Magic Math” of investing.

In order to most effectively engage my audience, having the kids participate in a discussion and think things through, I came up with a two-question “Magic Math” quiz.

It was so effective, I wanted to share it with my clients and Juris Wealth friends.

My bet is that most you will get these answers wrong. More than that, my prediction is that you’re going to be wildly off in at least some way….

Question One

For this question, you have to guess the value of four numbers.

Assume that someone in your family invested $100 in the US stock market (using the S&P 500 as a proxy) for you at various different times in the past. Specifically, if that $100 was invested in either 2014, or 2004, or 1974 of 1924, how much would it be worth today?

Go ahead, give it a guess. Seriously. I’m guessing you won’t even come close to at least one, if not two of these numbers.

If that $100 was invested 10, 20, 50 or 100 years ago, today you’d have $316, $621, $19,739 and $2,212,450, respectively. Said another way, that $100 of compounding returns over that amount of time would result in you having 3.2x your money, 6.2x your money, 197x your money and 22,125x your money! *

Seriously, did you even come close to that last figure?

Question Two

For the next question, let’s lay out a slightly more complicated – but more realistic – real-world example.

Instead of someone else investing on your behalf, you’re the one investing. For yourself.

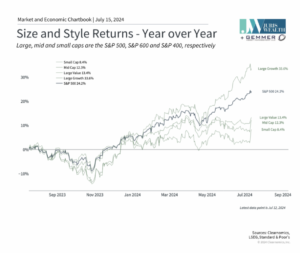

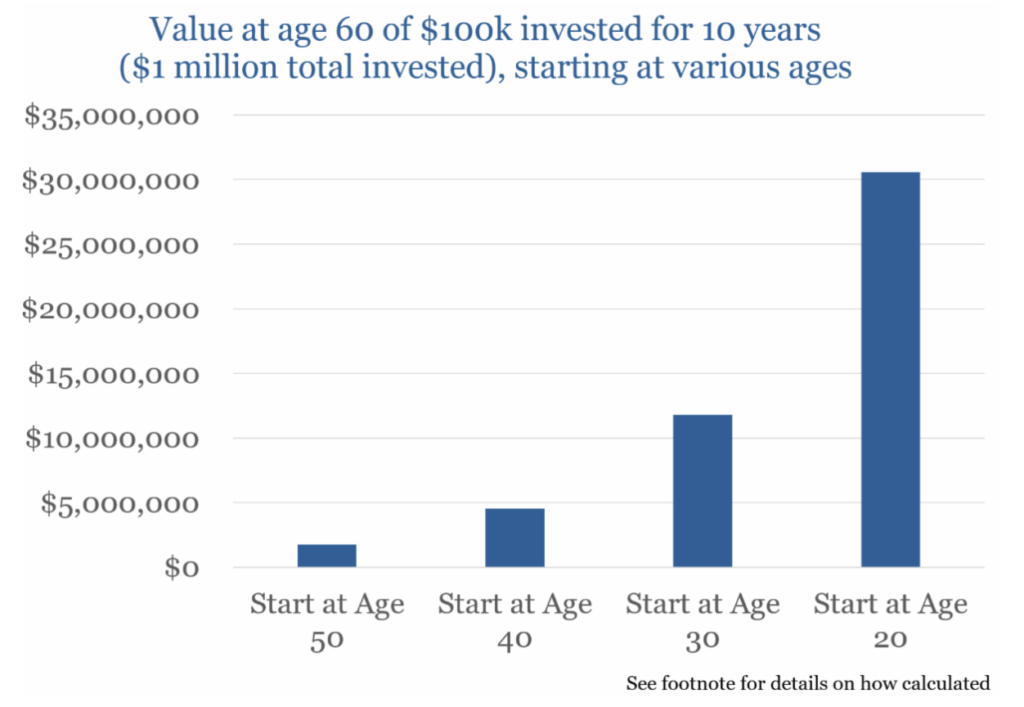

Suppose that over the course of our own lives we’re going to invest a total of $1,000,000 in the stock market, and that we do so in equal amounts over ten consecutive years, at a pace of $100,000 a year. We can choose to start investing either at (a) age 20, (b) age 30, (c) age 40 or (d) age 50. But once we start investing, we have to invest for 10 straight years, and then stop. Never to invest again. Let’s further assume that we earn a 10% compound return on your money, which is roughly what annualized stock returns (assuming you reinvest all dividends) have been for the last century or so.

The question is, how much would you have at age 60 under each of these scenarios?

The answer is that you’d have (a) $1.75 million if you started investing at 50, (b) $4.54 million if you started at 40, (c) $11.8 million if you started at 30 and (d) $30.6 million if you started at 20. *

Below is a graph of these numbers.

Again, each of these individuals invested exactly the same amount of money, over exactly the same amount of time.

The only difference is when they started.

Did you come close to guessing the right answers?

Do you see why I think this is the one thing so fundamental and important to share with young people? Because of the critical importance of time. The impact of starting investing sooner vs. later is not small. It’s enormous. It’s so enormous you couldn’t even guess the impact. But now you know.