You’ve undoubtedly heard of the proverbial “average family” with 2.5 kids. Some families have no kids at all, some have two, some have 10. Put them all together and find the average, and you’ll come up with a single number which best represents them all. And while such an “average family” may tell you a lot about families in general, there’s something unique about this family as well: no such average family has ever existed.

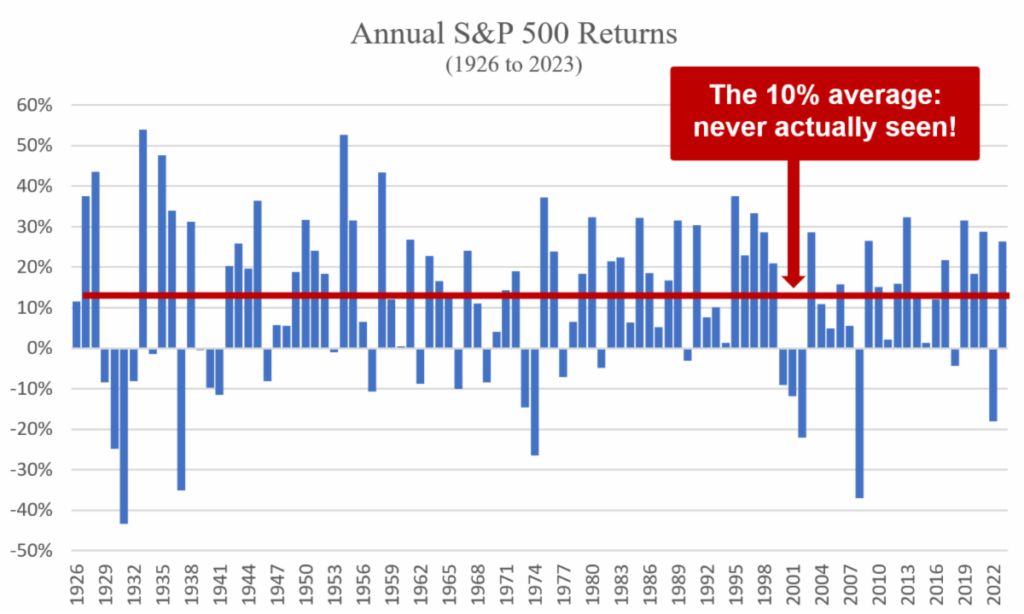

There’s a similar dynamic when you look at the stock market. Over the last 98 years (since 1926, just before the Great Depression), the U.S. stock market has delivered an average annual return of around 10%*. Can you guess how many years produced the average 10% return? Yep. Precisely none.

Like the “average family”, the “average stock market” return simply doesn’t exist when you look for it in any particular year.

What if we look for years which might have close-to-average annual returns – say, within 2% or so of average return – how many years were there in which returns were between 8% and 12%? These are also quite rare. In fact, there were just 6 years (out of 98) where annual returns were between 8% and 12%.

That means your historical odds for even having close to the average return was close to 1 in 20.

Why is this important? Because the only way you would have earned that average 10% return is to live through lots and lots of years (most of them!) in which the annual returns were generally far less, or far greater!

What we see here is nothing more than the basic investment principle of the relationship between investment risk (i.e., volatility) and return. The price of earning that 10% average annual return is the bumpy ride. That’s just the deal.

OK… so what?

The “so what” of all of this is simple: having a firm understanding of how the stock market behaves is a critical element to being able to stick to your wealth creation plan regardless of what the market is doing any particular year. The stock market may have generated an “average” 10% annual return, but if history is any guide – you’ll never actually see that in any particular year.

As of this writing, we happen to be in a period where the market has been up for a few months. Investors are (generally speaking) happy right now. Great. I’m glad the market has generated additional wealth for my clients over the last few months. Yet it could easily have been the reverse. More importantly, at some point, it will be the reverse. That topic (of the inevitability of bear markets, and how to deal with them) is big enough it deserves its own blog post, so we won’t address that here. What matters is we steel ourselves with knowledge so as to live through whatever the markets throw at us.

And so, in this happy investment spring of 2024, when you sit down to dinner tonight with your family, have a toast to your actual family, whatever that looks like. Don’t compare yourselves to the average family, they don’t even exist. I mean, who wants an average family (or stock market) anyway? I like them both just the way they are.

*Source: S&P 500 return data from Bloomberg, internal calculations