As we’re well into spring, with summer just around the corner, I’ve been thinking about the weather, as it seems particularly fickle this year. A few days of cold and rain, a day of sun, then cold again, then some sun, etc.

While I live in California now, I grew up on the east coast, and am reminded of the Mark Twain quote about his experience in New England:

“If you don’t like the weather, wait a few minutes.“

As we look forward to longer days and (hopefully) the better weather that summer brings, it occurred to me that there is an interesting – and instructive – analogy between our experience with the weather, and our experience with the markets:

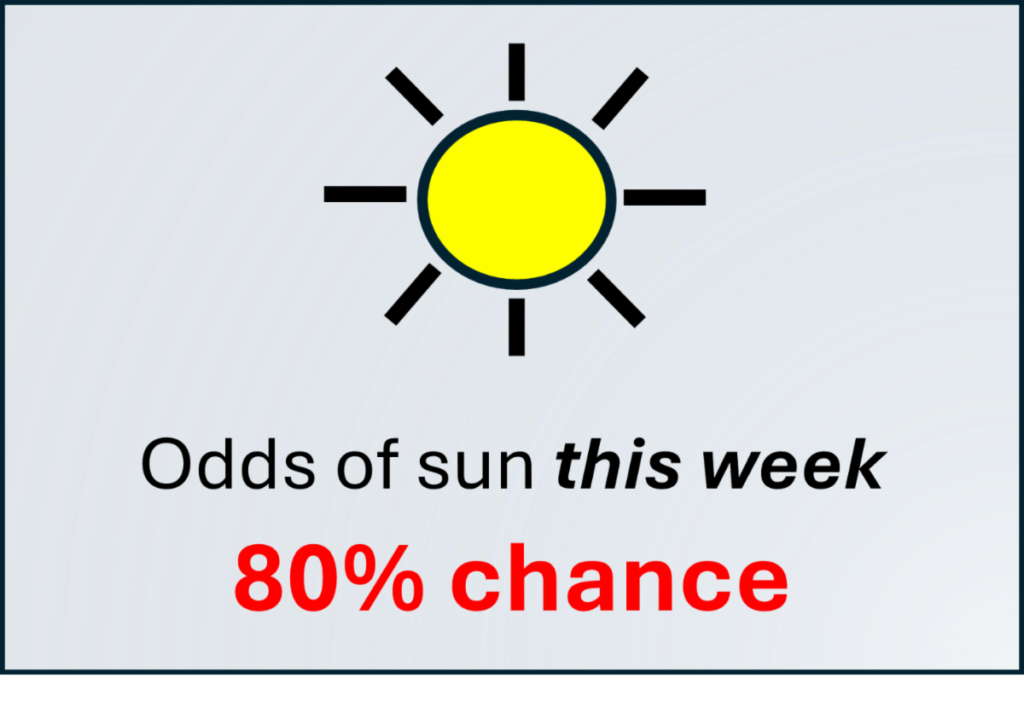

Let’s assume we’re in Boston, in April, and we are looking at the weather forecast. The meteorologist might say:

“There’s a 50% chance we will see the sun today.”

Great, another toss-up of a weather day.

But wait, the forecast continues, with the meteorologist saying:

“As the weather system moves through, we should get some breaks in the clouds, giving us an 80% chance of sun this week.“

Knowing the Boston television audience is dying to see some sun, the meteorologist continues and is able to offer this (fact-based) optimistic assessment:

“Even if the storms continue into next week, we’ve never had a full month go by without some amount of sun, so we’re going to put the odds of some sun at 100% this month.“

See what’s going on here? The odds of sun in the forecast go up the longer out you’re looking.

The odds of sun in our forecast go

up the longer out we’re looking

What does this have to do with investing? Let’s ask an investment focused question from the same general perspective most people ask about the weather, that is, in the short-term: “will the market go up today?”

Instead of asking a weatherman, we’ll look to what the market has done in the past and ask the question retrospectively.

Based on the S&P 500’s historical performance* (assuming dividends are reinvested) as a proxy for the market, we can say:

“The odds of the market going up any particular day is 52.4%”

But what if we ask: “will the market go up this year?”

Again, looking at the historical data, the “forecast” for positive returns goes up. I can say: “The odds of the S&P 500 being up in 12 months are 75%.”

By the time we get to the longer time frames that are relevant to saving money for retirement (i.e., decades), we can say:

”Based on history, the odds of the market being up over 20 years is 100%.“

This is such a powerful fact that it deserves to be elucidated a bit more clearly.

Even if you picked the single absolute worst possible time to invest, so long as you reinvested your dividends and stayed in the market, you’d still have a positive return.

If history is any guide – and I believe it is the best guide we have – the expectation for positive stock market returns simply goes up with the longer time you are invested.

The odds of positive stock market

returns go up the longer you are invested

If you’re a client of mine, your time frame is generally going to be decades.

That’s true even if you’re already in retirement.

We’re playing the long game. And the forecast for this long game looks to be quite sunny. And that has nothing to do with whether you live in New England or California.

*For illustration purposes only. Stock market returns over various time periods do not constitute projections, but reflect historical returns based on the S&P 500 (dividends reinvested) from January 1, 1926, to March 31, 2024. Past performance is not a guarantee of future results. Source: Bloomberg data. One year and twenty-year return calculations are done on a rolling basis in 1-month increments.