As a financial advisor to lawyers, one of the most common – and often most controversial – financial planning topics I cover is whole life insurance (sometimes known as universal life).

Over the years I have reviewed dozens upon dozens of such policies, analyzing them in detail. Have you ever read through a 30+ page “in force illustration” filled with complicated financial tables, contract terms and disclaimers?

I have, many times. I’ve reverse engineered the math so as to explain to my clients the economics of these policies, pointing out the details (where the devil hides) and really dug through the weeds so my clients understand these things.

Yet through all of that work, I’ve come to believe that perhaps the most effective way to explain what these contracts are is by using an analogy:

Whole life insurance is a lot like those 1960s car-boats: the Amphicar.

When these came out, I suppose the claim was that these cars brought you the best of two worlds. Why own a boat and a car when you can have it all in one package?

Why not buy one? Simple. The Amphicar was both a bad car and a bad boat.

Just as an Amphicar represents the unnatural spawn of two otherwise healthy transportation species, whole life insurance policies are an unnatural and poorly functioning combination of an insurance policy and an investment.

Why whole life insurance is bad insurance – The purpose of life insurance is to ensure that your dependents are not financially devastated in the event of your death.

Because of this, the amount of life insurance you need changes over time: starting at a very high amount when young and dropping to zero as you get older.

The 30-year old lawyer with 2 kids, a non-working spouse, and a large mortgage needs a lot of insurance, maybe $3 or $4 million or more, such that if he or she were to die, the proceeds from the policy can pay off the mortgage, put the kids through school, and make sure the surviving family is financially secure.

Flash forward when that 30-year-old turns 65, the kids are through college, and the house fully paid off. He or she doesn’t need any life insurance at all.

At that point in life, my client is effectively “self-insured”.

The type of insurance you need for this context is very clear: term life insurance. This is insurance that only covers that period of time – the term – when you need it.

Whole life insurance is simply “bad” insurance in this context because it’s just not the kind you need. Whole life covers you for…. wait for it… your “whole life” not just a limited period of time when you need it.

You might say “who cares if you buy whole or term, so long as you’re covered when you need it?”

You care, because whole life insurance is way more expensive than term insurance on a coverage-per-dollar basis. I’ve seen whole life policies that are 20, 30, 50, even 70 times more expensive than term insurance!

But if you think about this from the insurance company’s perspective, that makes sense: whole life should be far more expensive than term.

With whole life, the insurance company knows, with absolute certainty, that you will eventually die and so the payout likelihood on the policy is 100%. They have to charge enough premiums over the years to not only pay that out, but to earn their profit along the way as well.

With term life insurance, on the other hand, the insurance company knows that there is a very high probability that it will not pay out the policy value during the term because the odds are (usually) overwhelming that you will not die during the period of time the coverage is in force.

These are totally different bets by the insurance company, and so they charge you based on the risk. With whole life, they’re going to pay out on the policy, it’s just a matter of when. With term life, they’re hoping never to have to pay out.

Why it’s almost certainly a bad investment for you – First, let me start with a technicality, which really isn’t a technicality at all.

When you have a whole life policy, you do not have an investment. You have a contract with an insurance company.

You may have heard an insurance person talking about the “cash value” of a policy. “Cash value” is not the same as “cash.” Your cash is gone, taken by the insurance company which is now focused on maximizing the spread between what they can earn on the money they take in, and what they might eventually have to pay out to their policy holders. If you didn’t know, this fundamental way of making money is a central pillar in Warren Buffett’s investment empire. (That alone may be reason enough not to buy whole life insurance. If Warren Buffett is on the other side of your trade, you should be a little bit nervous).

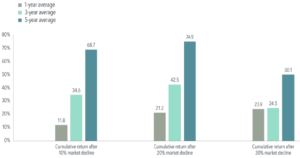

Still, I know insurance salespeople like to say these policies are a form of investment. OK, so if we calculate the “return” on your policy premium payments in terms of what the cash value of your policy may be in the future, the returns are low. Based on the policies I’ve reviewed, the returns are in the low single digits. The “in force illustrations” always show better projects. Do NOT count on these. Do not even count on the historical “returns” shown, as I’ve found them to be highly inaccurate and highly misleading, for reasons I can share with you.

What to do if you have such a policy?

So here you are, the (somewhat unwitting) owner an Amphicar. Now what?

First, do not feel badly if you have such a policy. I really mean that.

Several of the smartest people I know have purchased them. The insurance companies are incredibly good at selling these products, and hitting all the hot buttons (tax-free growth, ability to access the value of the policy later, guaranteed returns, etc.) All of this talk is very effective smokescreen to keep you from focusing on the simple truth of these policies. Remember: (a) bad insurance, and (b) bad investment. Everything else is noise and does not change that core truth.

Second, to figure out the path forward, you have to understand the economic pros and cons of staying in the policy vs. walking away.

Every single contract I’ve looked at is structured in such a way that seems designed to provoke the visceral reaction: “I’ve got to stay in, otherwise I’ve wasted all this money!” I believe this is carnival-game-level emotional manipulation, and it really bothers me.

A clear-headed and rational assessment ignores the sunk-costs and looks only at the economics on a go-forward basis. If you’re not sure how to run the numbers, I can help you.

And when we look at the specifics, I have had clients rationally decide to remain in these policies, in which case we almost always look at them as low-returning illiquid components of a bond allocation. Other clients have walked away believing the opportunity cost is too high for the money they would otherwise spend on future premiums. The right answer for you is dependent on your policy and the facts of your financial situation.

Finally, please know that the the interests of the person who sold you the policies is almost certainly not aligned with yours. No matter how much you like him or her and no matter how sincere they are in their belief that this really is a good policy for you. And please, do not talk to me about tax-free growth, or the ability to borrow against your policy, and how it fits neatly into a thoughtful financial plan. If you do, I will explain to you how the Amphicar fits nicely in your garage too, and how it moves almost seamlessly between the highway and the lake.

For those of my clients who would like to refresh your financial plan and projections, please give me a call. Let’s take a look at where you are, and make sure you’re headed towards a comfortable retirement.