While we’re in the eye of the storm, it’s as important as ever to maintain an informed perspective. I share the following thoughts with you after a momentous week, marking a bear market (down 20%), the week President Trump shut down all traffic to Europe (and now the UK), the week the NBA season was suspended, the week Tom Hanks was diagnosed with the coronavirus. Things are happening so quickly, you may not have heard of all of that yet. All true. A crazy time. But with all that, please absorb the following. It’s not about the market, or what it’s done today, or allocations or risk management or investment styles or any of that. It’s far more important and basic than all that.

First, a confession. I’m not – by nature – an optimist – I have never been one of those people who can easily see – or more importantly, easily believe in – the positive outcome of any possible scenario or problem. I have always been keenly aware of the what-if risks in life, whatever they are. My training as an attorney may be partly to blame for this, as we are taught to think deeply about problems, and both actual and potential implications, even if not immediately obvious. If there’s a word to describe my outlook, it’s probably as a “realist.” What I see in the coronavirus and its impact on the world, the economy and the stock market – Things are scary right now. From the start, I have never been one to think “this is just the flu.” It’s scary, and actually pretty dangerous. I think the global economy will be hurt, and that it will take some time to recover from this. Markets are reflecting this, and will continue to do so. The ride is already painful, and the future could bring more pain. Be prepared for that. There’s no sugar-coating it.

And yet… Life Finds a Way… Please understand that the view I’m going to share here is not simply being Pollyannaish. Or a reflection of me being an optimist (which again, I most certainly am not). Or me trying to play cheerleader to sullen investors smarting from a very painful and sudden bear market. I believe the following in the very core of my being because I am a realist: And it’s clear to me that optimism is the only realism.

Think about that.

Optimism is the only realism. I’m not talking about being optimistic about what stock prices will be tomorrow. Or next week. Or maybe even next year. I’m talking about the optimism relevant to financial plans that we have constructed for the coming decades. And as one of my favorite authors, Nick Murray wrote, “Optimism is the only worldview which squares with the facts, and with the historical record.”

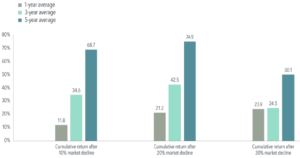

If you get caught up in the market anxiety and short-sited focus about what the stock markets are doing today, you risk missing the fundamental and critical dynamic here: we have faced – and will continue to face – nearly innumerable challenges to our progress in the short-term. The Coronavirus is the boogeyman we’re wrestling with today. And while a toll will be extracted, we will succeed in moving past this time. And 5 or 10 or 15 years after that, I promise you there will be another challenge thrown in our way. The future will be no different than the past. Over the last few decades we’ve seen 9/11, the Gulf Wars, the Global Financial Crisis, and lots of other bumps along the way. It’s the coronavirus today. And tomorrow it will be something else.

And through it all, people find a way to overcome, and thrive. And as investors, the riches that generates is nothing short of astounding. That one dollar, one dollar, invested in 1926 to take advantage of the wealth created by large US companies over the last century, would have grown into well over $7,000 last year. Invested in small caps (small company) stocks, it would have grown into $20,000! One dollar.

The forces we are harnessing in capitalism as stock investors are irrepressible and enormous. It reminds me of a scene from the movie Jurassic Park, where Jeff Goldblum is trying to articulate the irrepressible force that the scientists are trying to control when cloning dinosaurs. In this key scene, Jeff Goldblum summarizes this as follows: “I’m simply saying that life… finds a way.”