Did you ever have an experience where you take a class from an expert, and you’re surprised at how much the initial focus there is on the basics?

The golf coach who insists that you don’t grip the club too tightly.

The artist who insists that you know the color wheel, and which colors are complementary.

The musician who insists that you be able to play the major and minor scales.

As students, we all want to just get out their and start hitting golf balls, or start painting the landscape or start improvising that piano solo.

Yet the reason that these teachers and coaches have such a unerring focus on the basics, is that without mastering the basics, they know that it is very unlikely we will succeed.

The longer I have been in the investment management industry, the more I see the same dynamics when it comes to investors. And in this context, I offer the following 5 “back-to-basics” of investing.

If your approach to investing is incongruous with any of the following, you’re almost certainly not doing as well as you could. And it may be time to go back to the basics…

1. Embrace market pricing

The market is an effective information-processing machine. Each day, the world equity markets process billions of dollars in trades between buyers and sellers, and the real-time information they bring helps set prices. There are so many participants, and so much money involved, this is an incredibly efficient pricing machine. Trust that it works.

2. Do Not Try to Outguess The Market

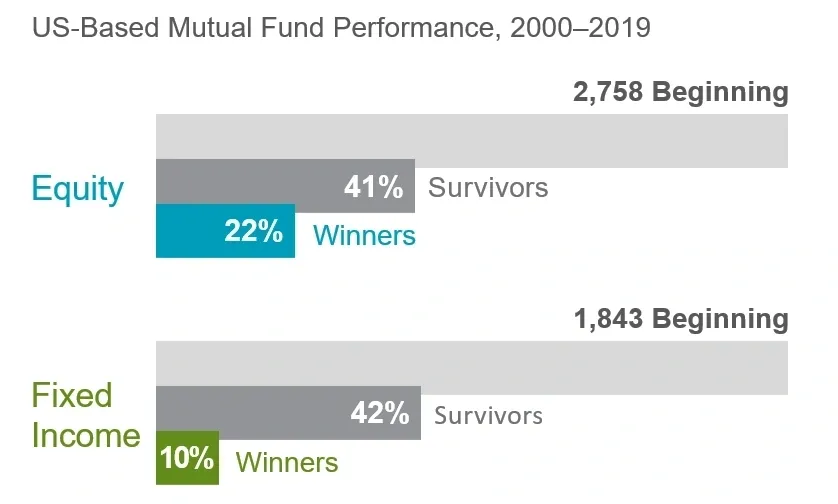

The market’s pricing power works against those who try to outperform through stock picking or market timing. As evidence, only 22% of US equity mutual funds and 10% of fixed income funds have survived and outperformed their benchmarks over the past 20 years.

3. Do Not Chase Past Performance

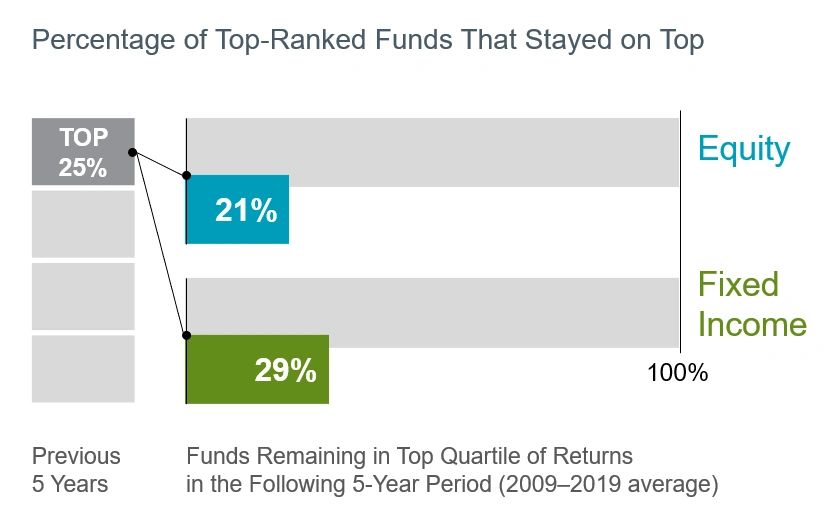

Some investors select investments based on their past returns. Yet, past performance offers no actionable insight into a fund’s future returns. For example, most mutual funds in the top quartile of previous five-year returns did not maintain a top‐quartile ranking in the following five years.

You’ve heard the phrase “past performance is not indicative of future results,” right?

It would probably be truer for the stock fund disclaimer to read “…Since we’ve outperformed over the last 5 years, the odds are close to 5:1 that we’re going to underperform in the next 5 years.” Think about that.

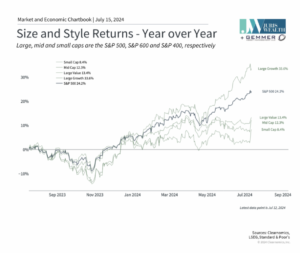

4. Stay Invested & Let Markets Work For You

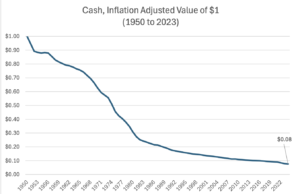

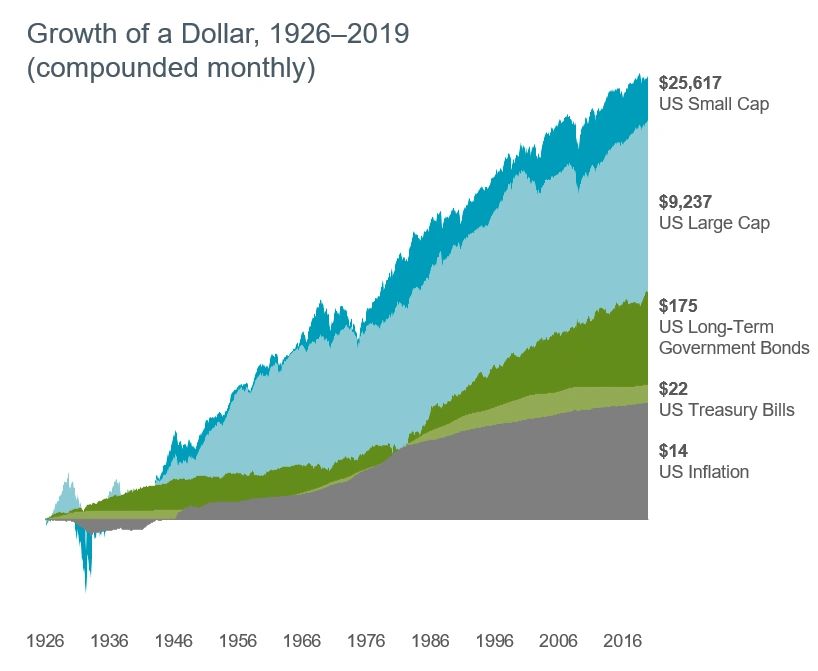

The financial markets have rewarded long-term investors. People expect a positive return on the capital they supply, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation. But to get these returns, you have to be IN the market. You can’t wait until after Covid. Or after the election. Or after… anything. Just get in. And stay in.

5. Ignore The Headlines

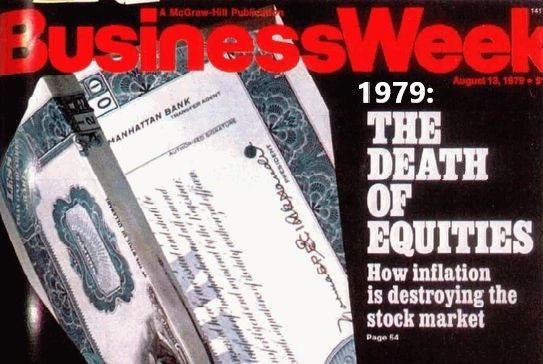

Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. When headlines unsettle you, maintain a long‑term perspective. Here’s an interesting BusinessWeek cover from 1979. They nailed it, right?