While April 15 this year is no longer Tax Day (which has been pushed to July 15), it is still a good time to highlight just one of the reasons why tax loss harvesting makes so much sense.

If you’re not familiar with the strategy, it works by selling investments which have declined below your purchase price, generating a loss that can be used to offset taxes you would otherwise owe.

Importantly this includes the ability to reduce the amount of taxes you’d otherwise pay on your W2 or K1 income from your legal practice.

Specifically, you can use up to $3,000 in capital losses every year (the kind you generate when you sell an investment at a loss) to offset ordinary income (the kind you generate when you receive your salary and profits from your job as a lawyer).

If you’re in a high-tax state*, and have an effective tax rate close to 50%, that $3,000 in capital losses might save you close to $1,500 in income taxes this year.

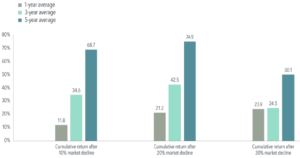

And if you generate more than $3,000 in capital losses now, you can simply “bank” the amounts above $3,000 that you can’t use this year and carry them forward to be used in the year (or years) to come.

Think of it as a “Tax Savings Account” that you’re allowed to contribute these losses to, and use over time to save on taxes.

With this “Tax Savings Account” you’d save that $1,500 in income taxes this year, $1,500 next year as well, $1,500 the year after that, and so on until you have used up your tax losses.

(To be sure, you can always use the capital losses to offset any capital gains you may have along the way, but my focus here is on the benefits to reducing your income tax bill.)

For those of you who don’t know, here’s the basic outline of how a tax loss harvest trade works:

1. We sell an investment that has declined in value since purchase, triggering a tax loss.

2. In order to maintain a consistent portfolio allocation, we immediately replace the investment we just sold with a similar (but not identical) investment. Think “Sell Coke, Buy Pepsi.” We can’t simply immediately repurchase the asset we just sold, or even one that is “substantially identical” as it would then be considered a “wash sale,” which would disallow the tax loss.

3. After 30 days, we sell the replacement investment (Pepsi) and buy the original investment (Coke), so that the portfolio looks the same as it does before the transaction.

To be sure, there are several caveats and considerations here, which I’d be happy to discuss with you.

One to highlight is the fact that future taxable gains on your investments will be higher than they would otherwise be absent this trade, because we’re lowering our overall cost basis in the investment portfolio when we realize a loss today.

It’s still a very good trade to make, however, for 2 key reasons.

The first is a pure tax arbitrage: we are paying less (higher rate) ordinary income taxes today in exchange for paying more (lower rate) capital gains in the future. That’s a great deal.

The second is that YOU, not the IRS, gets to decide when to pay the tax on that later taxable gain, which could be far, far into the future. It’s even possible that taxes will never be paid on that gain, in the event you hold the stock until you die, and your estate gets a step-up in basis on that stock to the value when you die.

* A word of caution: while many states use the same IRS framework of allowing you to deduct capital losses to reduce taxable ordinary income, the rule is not universal across all 50 states. As they say: consult with your tax professional to ensure you get this right for your own return.