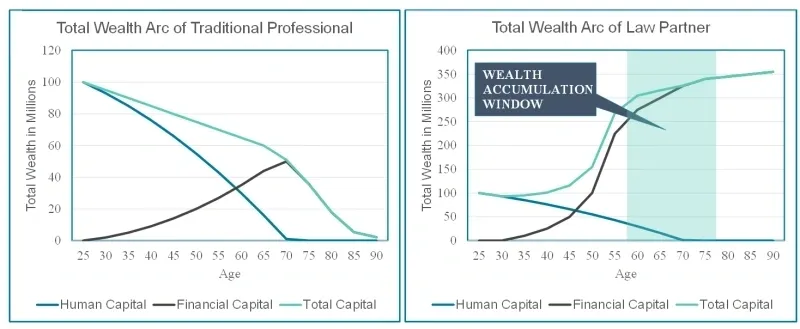

As a lawyer your financial situation likely differs from many others in the working world, including other professionals.

Your years of schooling came at a significant cost. Many lawyers come out of school with debt of well over $100,000. And even if you avoided substantial student loan debt or have completed repayment, those three years of schooling came at a significant opportunity cost in foregone income.

On the other hand, lawyers also have the benefit of significant earnings potential over the course of their career. The highest paid partners in the largest firms in the U.S. can earn several million dollars a year.

Yet earnings over a career, however large, are finite. This is particularly true for attorneys, who generate an income based on their human capital: meaning their income is a direct function of the hours worked. And at some point, we all run out of those hours.

For that reason, it is critical to recognize, and take full advantage of, any “wealth accumulation window” that you may find yourself in. This is a period of time in which your income is substantially greater than your current run-rate expenses, creating a surplus cash flow.

If managed correctly, this surplus income may be converted into wealth over time. By saving diligently and investing correctly, many lawyers can retire with real wealth to fund a comfortable retirement.

Based on my experience developing and implementing financial plans for lawyers across the country here is what I see as the single most important factor in determining whether or not you will be successful in creating wealth in this way:

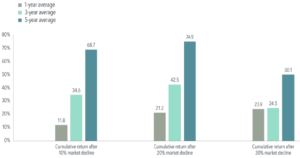

Saving and investing a clearly defined amount on a clearly defined schedule

My most successful clients primarily save and invest a consistent amount on a monthly basis.

Month in and month out, this is “throwing pennies in the bathtub” approach to wealth accumulation.

I think this approach may be so successful in part because the size of the monthly contributions appear – and are – manageable. This simply becomes a recurring and healthy financial habit, one that is fortunately hard to break.

Conversely, I can tell you that financial plans built around less frequent saving and investing – quarterly, semi-annually or even annually – tend to be far less successful in practice.

It may be because the profit distributions or bonuses that these are built around are variable, and so that the saving and investing amount is also variable, lacking the disciplined consistency of smaller monthly contributions.

Or it may be that the “once-a-year” contribution amounts are quite large vs. smaller monthly contributions and it is harder to actually pull the trigger to invest larger amounts. I also believe that large distributions or bonuses are easier to earmark for large-scale expenditures, leaving less to save and invest.

An analogy comes to mind.

Think of the gym-goer who shows up every day at 6 am for 30 minutes of cardio and 30 minutes of weights. They’re fit and healthy and going to the gym is as routine as brushing their teeth. That’s the person who saves a consistent amount every month.

Now think of the person who plans on going to the gym after work, if they have the energy after doing everything else that day. That’s the person who saves and invests some amount (never an explicit target) of their annual bonus.