Markets and investors have been rattled by President Trump’s recent tariff announcements. Are we headed into a recession? Will the US dollar continue to weaken? Will markets fall further? Is American economic dominance at an end? As investors, what should we do?

With a stark shift in US tariff policy announced on April 2 and ongoing responses worldwide, many investors are on edge. Volatility as measured by the VIX index has spiked to levels not seen in nearly five years. When there

Albert Einstein famously referred to compound interest as the “eighth wonder of the world.” That quote, and the fact it was Einstein who said it, got me thinking about a concept from physics: escape velocity. Escape velocity is the speed a

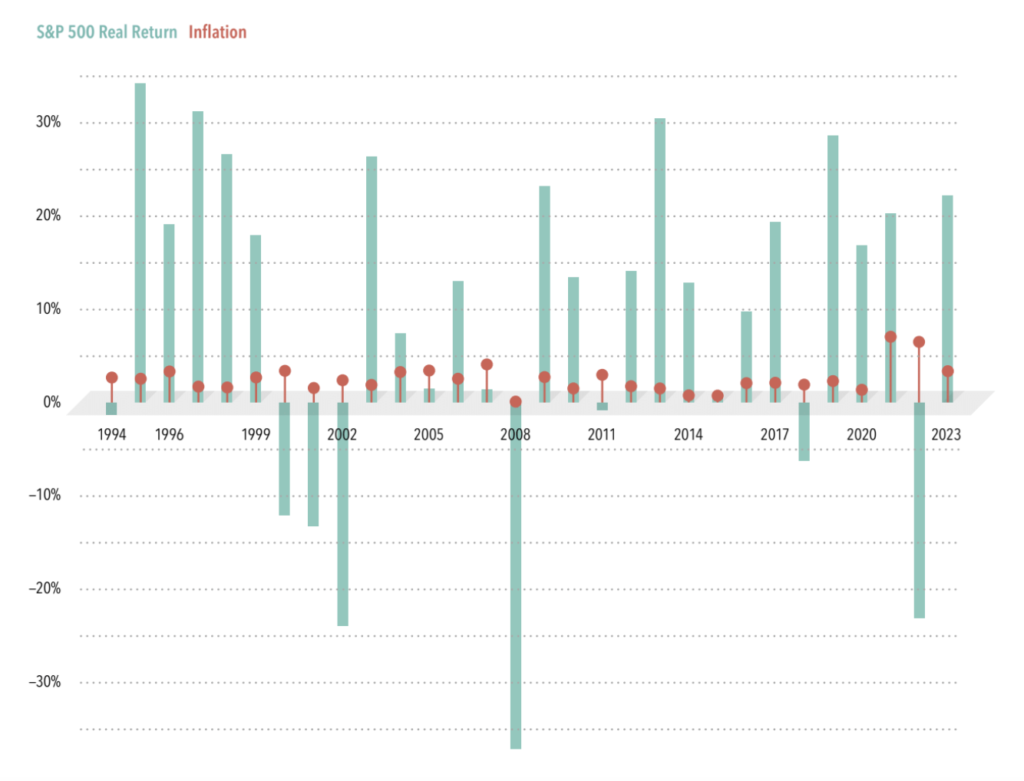

With inflation consistently in the news, clients may wonder whether stock returns might suffer if inflation keeps rising. If we look at equity performance and the annual inflation rate over the last three decades in the U.S. (see chart below) the simple answer is that we’ve

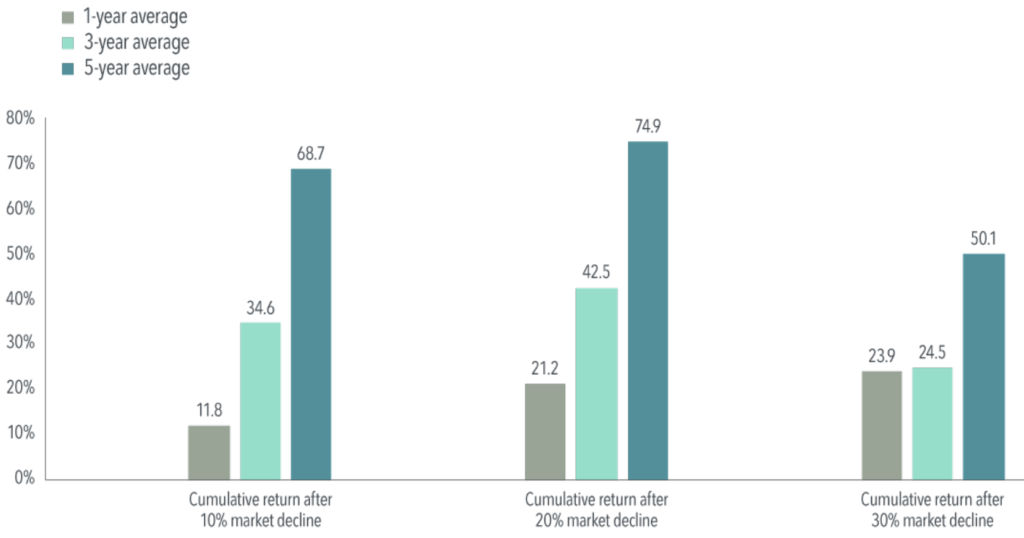

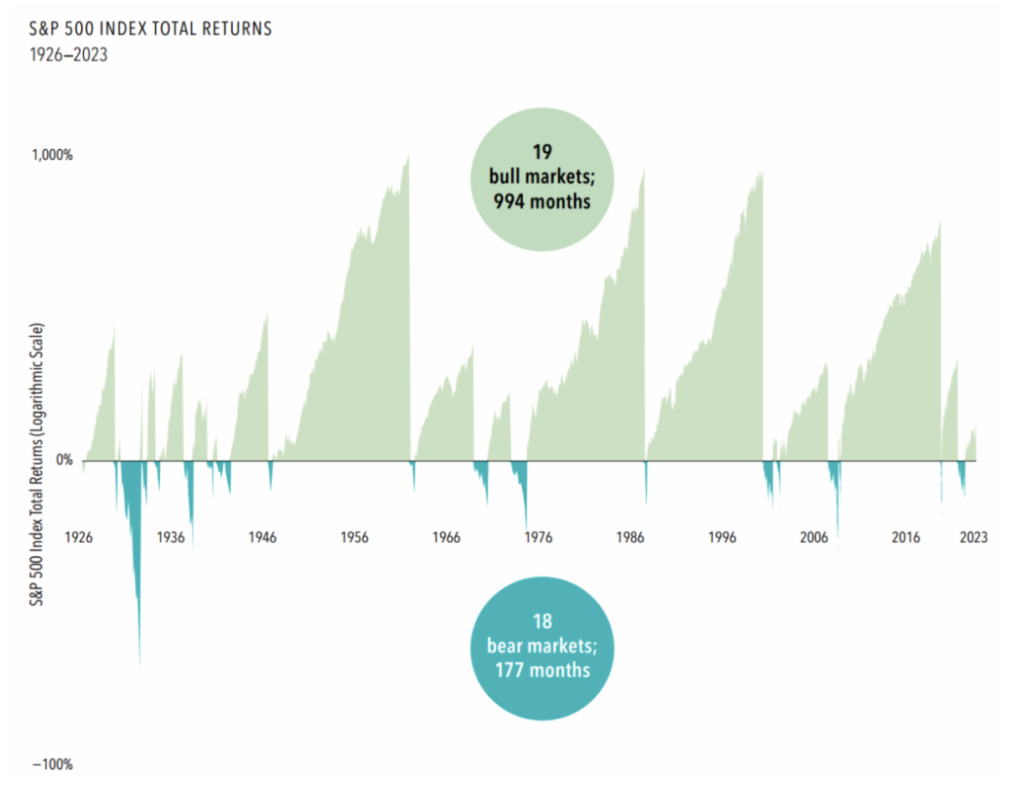

Stock returns are volatile, but nearly a century of bull and bear markets shows that the good times have outshone the bad. The stock market’s ups and downs are unpredictable, but history supports an expectation of positive returns over the

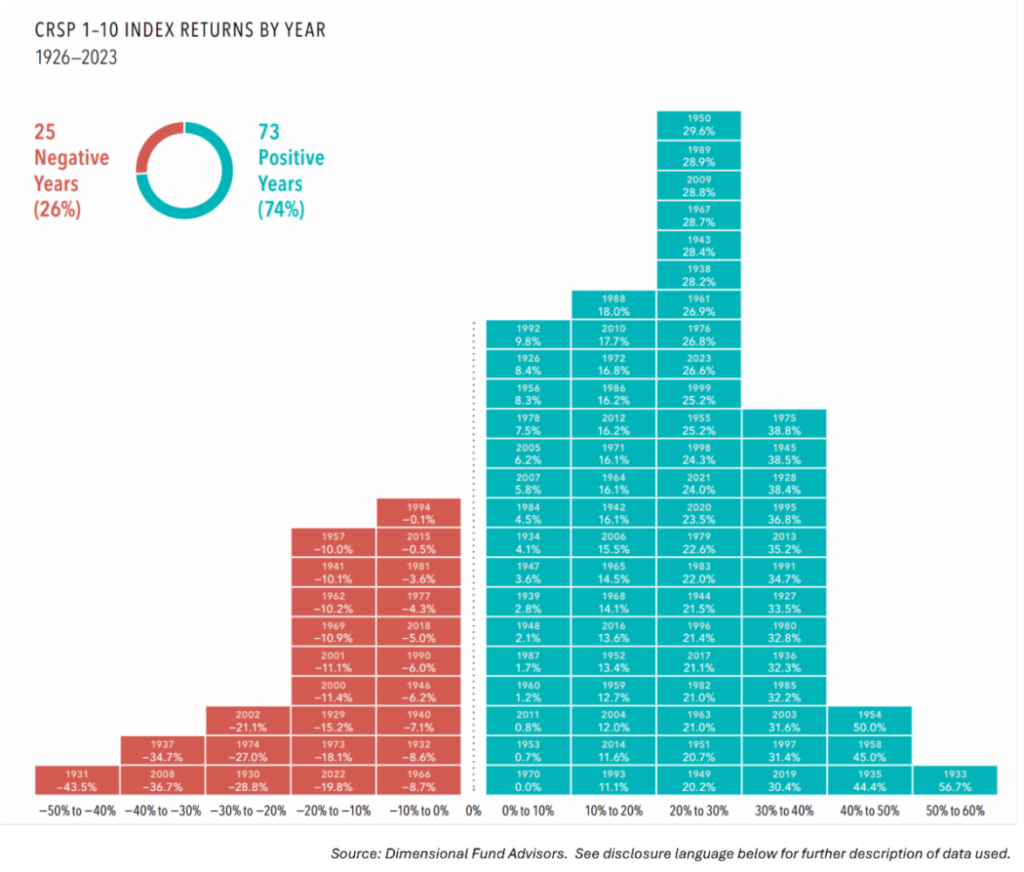

Annual stock market returns are unpredictable, but the long history of positive returns may be reassuring to investors who find market downturns unsettling. What’s the conclusion? The stock market tends to reward investors who can weather annual ups and downs and

I spend a lot of time with clients who are nervous about the market. Nervous that the market has gone up a lot and is now too expensive. Nervous that it’s going down and will likely fall further. The unfortunate

If you’re investing with a goal of building wealth, I think investing in individual stocks is a bad idea. The clearest reason is that historically most stocks generate very poor returns. Overall market returns have been driven by a relatively

Tim Corriero, J.D, CFP ®

Tim Corriero is an attorney, a Certified Financial Planner ® and founder of Juris Wealth, a financial advisory business for lawyers.

Free eBook