Albert Einstein famously referred to compound interest as the “eighth wonder of the world.”

That quote, and the fact it was Einstein who said it, got me thinking about a concept from physics: escape velocity.

Escape velocity is the speed a rocket must reach to break free from Earth’s gravitational pull. Once it hits that threshold, the rocket is no longer tethered. It can enter orbit, or head into deep space.

For the young lawyer, I think there’s an instructive financial parallel here, something we might call Financial Escape Velocity.

Let me explain. In a capitalist system, wealth accumulates through two primary channels: (a) return on labor (the income we earn from working), and (b) return on capital (the income our investments earn).

Early in our careers, the growth of our investments is largely powered by our labor. We don’t have a lot saved and invested, so our accounts grow primarily as a function of the money we are putting in. But over time, as our portfolio grows in size, we aim to reach a tipping point – a point of Financial Escape Velocity – where the portfolio is no longer bound to our capacity to work and earn.

It becomes capable of growing independently of our labor, just like a rocket that’s broken free from gravity.

Let me show you how this works

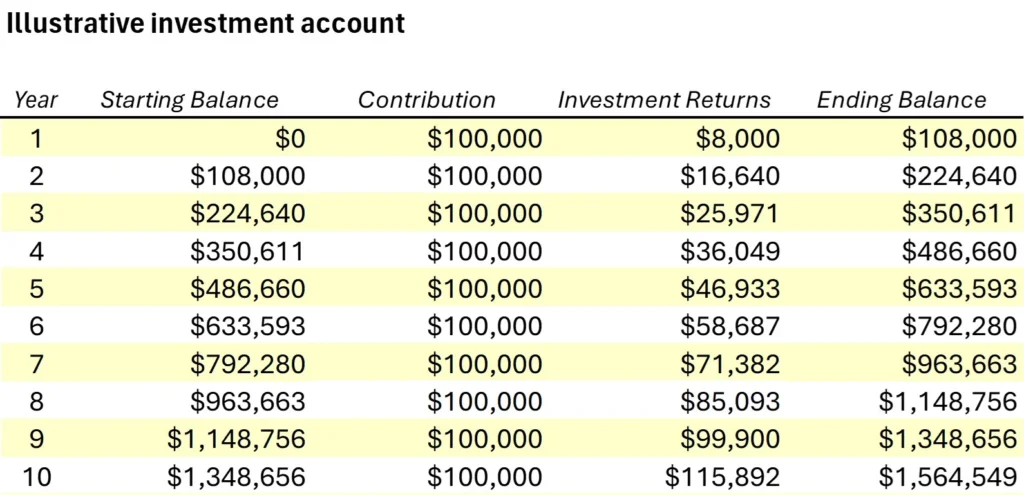

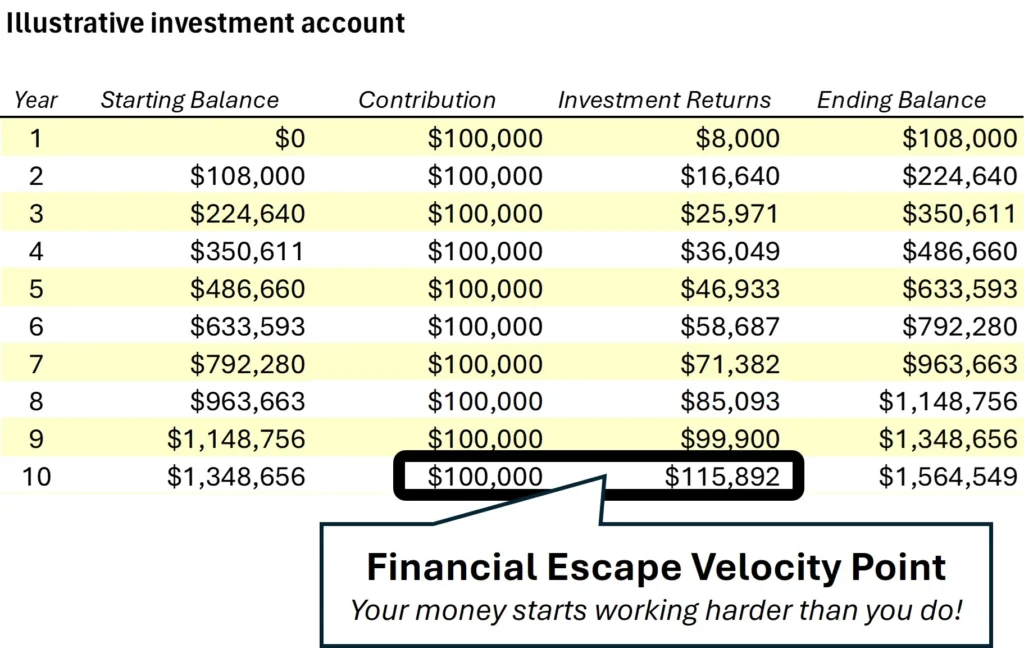

Consider a simplified example, a senior law firm associate who maxes out their 401(k) and is earning enough to save an additional $5,000 to $7,000 monthly. Using round numbers, this attorney is managing to save and invest about $100,000 annually. To keep the math simple, let’s assume an equity investment portfolio that generates an 8% annual compound return.* The following table shows how the portfolio grows over time:

Does anything jump out at you from the table? I’m guessing not. But make no mistake, there’s a powerful shift illustrated here, which you can find in Year 10. That is when the returns on the portfolio ($115,892) exceed the amount contributed to the portfolio ($100,000).

After nearly a decade of saving and investing diligently, our attorney has managed to hit Financial Escape Velocity! The scales have tipped. Compound investment growth is now the primary wealth-builder.*

Why This Matters

Why is this important? A hard-working lawyer might bill 150 to 200 hours a month, and do so year, after year, after year. But eventually, we all run out of hours to give. For most of us, it is only by trading our time for money, and in turn investing that money so it can start doing real work for us that we can be released from the bondage of the billable hour. And being aware of the power of compounding wealth – as Einstein was – is a powerful motivator to get to the tipping point of a Financial Escape Velocity as soon as you can.

Getting to Financial Escape Velocity

Having worked with hard-working attorneys of all ages for years now, here is how my most successful clients have hit Financial Escape Velocity as quickly as possible:

1. Start investing seriously! Early dollars invested are – by far – the most important, because you’re giving your money time to compound. A big mistake people make is simply waiting too long to start some serious savings.

2. Heavy allocation to stocks – Significant stock exposure has historically provided the returns needed to reach escape velocity. You have to have the stomach to deal with the volatility that comes with this approach.

3. Invest monthly – Make investing a comfortable ongoing habit based on smaller dollars but more frequent investment contributions. In my experience, you’re much more likely to stick to a disciplined plan this way vs. larger dollar but less frequent investing decisions. Infrequent investing is more likely to have you asking the question “is now a good time to invest?” It’s a terrible question. It’s always the right time to invest.

4. Ignore the noise – There will always be something in the news to suggest the world is about to fall apart. Ignore all of this.

Your Personal Financial Escape Velocity

The specific numbers for your own personal Financial Escape Velocity will vary based on income, saving rate, and investment returns. But the principle remains the same: there’s a tipping point where your money works harder than you do.

Tracking your progress toward this milestone can be incredibly motivating. Each year, compare your investment returns to your contributions. When the former exceeds the latter, celebrate! You’ve achieved Financial Escape Velocity and entered a new phase of your financial journey.

* The math in this example is intentionally simplistic, to illustrate the point. Investment returns are never consistently the same year-over-year, and most clients will increase their savings rate over time as their income grows. We’re ignoring a lot of important variables here, including costs, taxes, investment volatility, the fact that historical returns are not necessarily indicative of future returns, etc.