Markets and investors have been rattled by President Trump’s recent tariff announcements. Are we headed into a recession? Will the US dollar continue to weaken? Will markets fall further? Is American economic dominance at an end?

As investors, what should we do?

To answer these questions, let’s take a step back and think about what it means to be a long-term investor. What it really means.

A half-century time horizon

Consider a typical client of mine: a 40-year-old law firm partner, saving diligently for retirement. If she retires at 65, she’s had 25 years to save and invest.

But her retirement isn’t the end of the story. Her retirement itself could last 25 or more years.

So, for this 40-year-old attorney, we’re looking at an investment horizon of half a century; 25 years working and 25 years in retirement.

For those of you who might already be 65 or older and assume this example doesn’t reflect your situation: understand that if you plan to leave any money to others when you die, your investment horizon is longer than your expected lifetime. The key point is that ALL of us very likely have planning horizons measured in decades, not years.

There’s a subtle but fundamental implication that this long-time horizon has for investors, especially those who invest in broadly diversified portfolios (as all my clients do).

What we’re really invested in

Over this kind of time frame, contrary to what you might think, we are ultimately not invested in the success of any particular company. Or even the success of any particular industry. Or even the success of a particular country. We’re invested in something far bigger.

What we’re really investing in is capitalism itself.

Love it or hate it, we live in a capitalist system that ruthlessly directs capital toward innovation, rewards risk and evolves over time.

What’s this mean and why is it important?

Let’s take our 40-year-old attorney example but assume the year is 1975, 50 years ago. If our enterprising young client worked hard and was able to invest $10,000 in the S&P 500 stocks in 1975, assuming dividends were reinvested, that investment would now be worth over $1.5 million. (1)

But what, exactly, was she invested in that grew so much wealth?

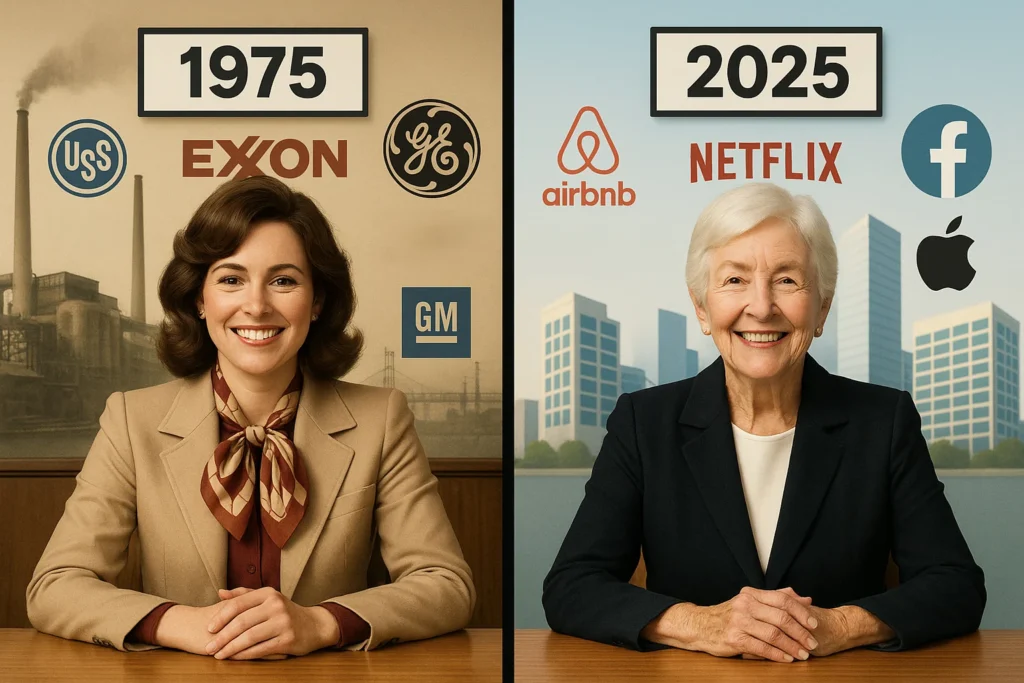

In 1975, the largest companies in the United States included industrial titans such as Exxon Mobil, General Motors, and U.S. Steel. (2)

By 2025, however, her investments would be heavily allocated not only in different companies – but in entirely different industries – that didn’t even exist in 1975.

Over this kind of time frame, contrary to what you might think, we are ultimately not invested in the success of any particular company. Or even the success of any particular industry. Or even the success of a particular country. We’re invested in something far bigger.

What we’re really investing in is capitalism itself.

Love it or hate it, we live in a capitalist system that ruthlessly directs capital toward innovation, rewards risk and evolves over time.

What’s this mean and why is it important?

Let’s take our 40-year-old attorney example but assume the year is 1975, 50 years ago. If our enterprising young client worked hard and was able to invest $10,000 in the S&P 500 stocks in 1975, assuming dividends were reinvested, that investment would now be worth over $1.5 million. (1)

But what, exactly, was she invested in that grew so much wealth?

In 1975, the largest companies in the United States included industrial titans such as Exxon Mobil, General Motors, and U.S. Steel. (2)

By 2025, however, her investments would be heavily allocated not only in different companies – but in entirely different industries – that didn’t even exist in 1975.

Taking the long view on tariffs

Yes, tariffs may hurt certain companies, even destroy some. But in their place new companies and businesses will arise, better adapted to whatever changes the new world will bring. Assuming you’re an index fund-based investor, fear not. You’ll own the new winners in time.

What this means is that it’s quite likely that your financial future will be shaped more by your reaction to the tariffs than by the tariffs themselves.

So if you’re my client, stick with your plan!

Tim

Sources

(1) https://ofdollarsanddata.com/sp500-calculator/

(2) https://money.cnn.com/magazines/fortune/fortune500_archive/full/1975/