If you’re investing with a goal of building wealth, I think investing in individual stocks is a bad idea. The clearest reason is that historically most stocks generate very poor returns. Overall market returns have been driven by a relatively small number of outperformers. And the odds of you picking the winners are against you. For example, this paper entitled “Do Stocks Outperform Treasury Bills“, published in 2018, concluded;

“[only] four percent of listed companies explain the net gain for the entire U.S. stock market… [the] other stocks collectively matched Treasury bills.”

An even broader analysis looking at stock market returns globally can be found in this paper entitled “Long-Term Shareholder Returns: Evidence from 64,000 Global Stocks“. The results were even more dramatic;

“..we find that the top-performing 2.4% of firms account for all… global stock market wealth creation from 1990 to December 2020. Outside the US, 1.41% of firms account for the [all the] net wealth creation.”

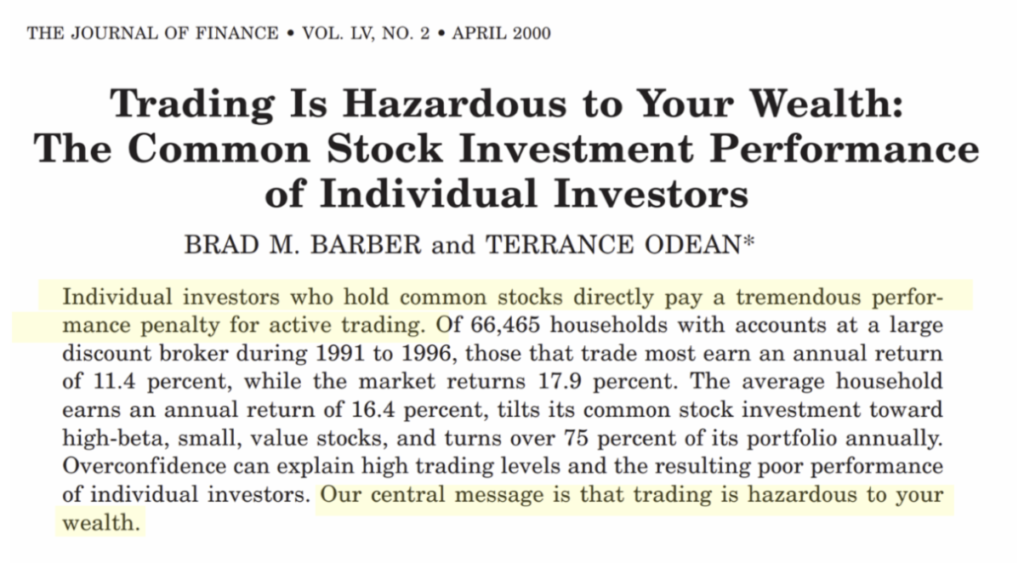

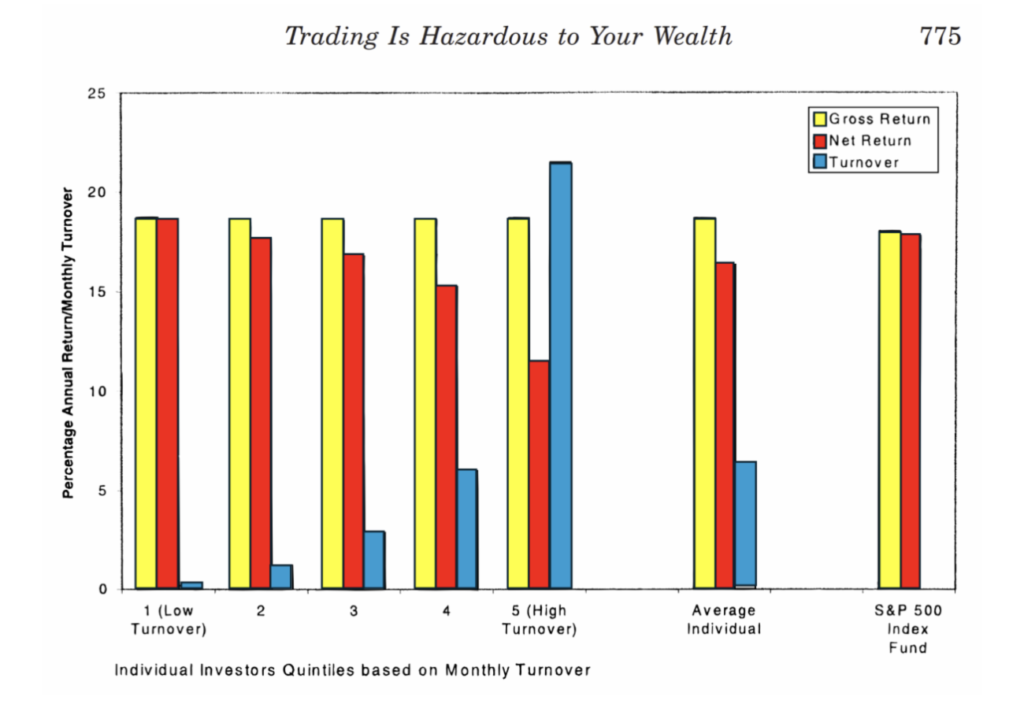

If the incredible concentration of stock market returns in just a few stocks wasn’t enough reason to avoid single-stock investing, there’s another dynamic which even further reduces your odds of winning this game: there’s very good evidence that the more you trade stocks, the worse your returns are. Take the conclusions found in this paper, entitled “Trading Is Hazardous to Your Wealth.“

What was great about this paper is that they were able to access trading data over several years for more than 66,000 households (that’s a lot) provided by a discount brokerage firm, the kind retail investors use. The authors were able to evaluate how the investors did, and look for relationships between trading frequency, and net returns. The authors segmented investors into quintiles, based on their monthly turnover (how often they traded). The turnover is reflected in the blue bars below. The first set of columns reflect those who traded least, and as you move right, you’ll see that turnover (trading) increases. The net returns that their trading generated is shown in the red bars. The more investors traded, the lower their net returns.

In summary, (a) very few stocks make up the majority of overall market returns, and (b) if you do any amount of trading to find these stocks, your net returns are likely to be worse. It’s a very tough gain to win. What is an investor to do? I think John Bogle said (wrote) it best:

Don’t look for the needle in the haystack. Just buy the haystack!

John Bogle, founder of the Vanguard Group